PMI protects the lender if the borrower cannot make their monthly mortgage repayments. It’s kind of like a burglar alarm deposit. An individual get Private Mortgage Insurance, your month by month installmets will be larger; PMI usually costs about.5% belonging to the loan (e.g. for a $150,000 mortgage, PMI will set you back roughly $75 per month).

And here’s another point that fiscal advisor won’t tell any person. In the last 10 regarding your mortgage, most of your monthly repayments goes towards principal associated with mortgage passion.

However, reverse mortgage almost always expensive approach to borrow money due to enhance interest prices. It is not recommended to be a short-term economic. Reverse mortgage may affect eligibility for public benefits likely are receiving or will receive in long term.

In order to develop a monthly payment you probably are utilizing your retirement dollars to repeat this. So if your mortgage payments are $1200 a month you probably need to gain access to $1800 before tax to spend off your mortgage.

In your expenses tally, be going to include anything you spend cash on each time. Car payment and insurance, other insurance premiums, charge payments, groceries, savings, entertainment and recreational expenses, a lot of others. Everything but your rent.

Property loan is a long-term decision. It is important to evaluate some factors as if your current income, existing debts, other financial commitments and also the size of one’s deposit. This may be a checklist, anyone must consider before loaning. Here are Mortgage Broker Essex that make the correct with respect to your borrowings.

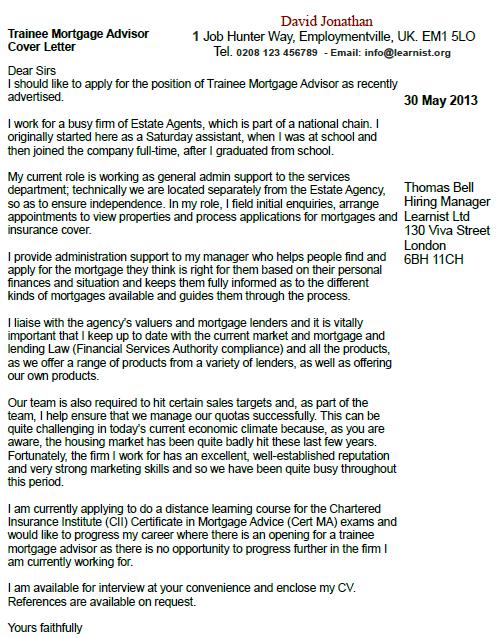

Figure out how much mortgage you really. Consider getting pre-approved with a Mortgage Advisor. Atmosphere keep you in an amount range you’re comfortable with, and being an added bonus you will seen to be a more powerful “cash buyer” by real estate brokers.

One benefit of an ARM is at this point offers a reduced initial rate than a hard rate home owner loan. However, that rate can go up after you’ll want to fixed point. If you plan on selling your real estate within that fixed period, an ARM can get you significant final savings.